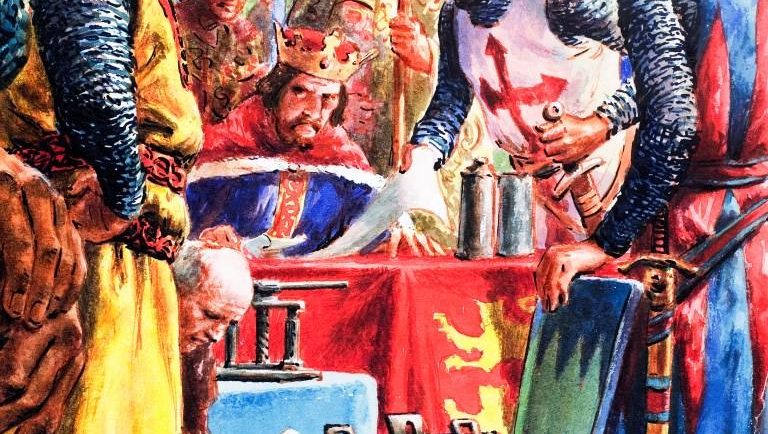

Eight centuries ago, in a muddy field near the royal fortress of Windsor Castle, the unpopular King John was forced to strike one of history’s most important bargains. A group of rebellious barons, resentful of his heavy-handed rule and even heavier taxation policy, coerced his royal seal to one of the most important documents in human history. That document, the Magna Carta, or “Great Charter,” ultimately established a system of checks and balances as well as the individual liberties now widely enjoyed by modern democracies around the world.

Today, another “Great Charter” of our time, the compact between the Federal Reserve and its crisis-era monetary policies, finds itself at an historic crossroads. Similarly born in a period of great contention and brought into existence without historical precedence, this policy changed the modern landscape dramatically. The effect has been to stabilize the markets and provide the backdrop for global economies to heal over time.

With the economic recovery now entering its seventh year, the job market tightening, and inflation concerns percolating, this extraordinary policy is no longer considered an absolute virtue by the markets. In addition, rising concerns over whether excessive accommodation, if left unchecked, is fueling financial bubbles as well as the continued impact of low yields on pension and retirement incomes only add to the ongoing debate over how and when rates should rise.

Those economic realities have brought us to a major turning point for our interest rate policy. So what should you expect from this coming policy reversal in the year to come?

The easy throwaway being offered by most advisors is that you should expect more volatility in the markets and in your portfolio. While it is true that a rate hike may mark a turning point in policy and create volatility, it hasn’t historically been an inflection point for investment performance. Instead, the first rate hikes tend to come during the middle of the business cycle, a period when most investments continue to produce positive performance. So while near-term volatility may present itself, that volatility has generally proven to be a wonderful opportunity for long-term investors.

So far, stocks have shrugged off the prospect of any threat from an imminent change in interest rate policy. The general view on Wall Street is that any negative effects on stocks from marginally “tighter money,” at least in the beginning of the rate cycle, will be offset by the positive benefit of a stronger economy. This rate hike shares a common thread with history as it is occurring in the middle of the current business cycle, when profits are strong and the economy is growing. History tells us that despite the rate hike, stocks have averaged double-digit gains in the year before and after the first Fed move. Our own view is slightly tempered, but still a positive one, as we expect mid-to-high single digit returns for stocks over the coming year.

Over time however, rising rates will chip away at two of the pillars that have supported this rally: cheap corporate debt and low wages. With profit margins close to all-time highs, the odds of margins contracting as a tighter labor market collectively “asks for a raise” will rise. To avoid a profit crunch, revenues will have to rise fast enough to offset the inevitable pressure on margins. Only time will tell how this dynamic will play out but we suspect given widespread underemployment it will be manageable, particularly over the intermediate period.

Bond market performance, however, has historically been tougher during new rate cycles. In the months leading up to and immediately following a rate hike, bond markets tend to be flat to slightly negative performers. But over a longer-term perspective, bonds have recorded average low-single-digit gains in the first year after a rate hike. A long-term investment approach with bonds is important both for investment performance reasons and as a store of value should any stock market volatility presents itself.

Of course every rate cycle is different and this one is absolutely unique. For starters, this rate cycle begins from unprecedented low interest rate levels. Additionally, the return to normalization in monetary policy is likely to occur in small, incremental, and predictable changes for some years to come into the future. To this end, the Federal Reserve has specifically telegraphed a “one and done” rate move this year, which will work to help cushion the blow to returns in the immediate term. Longer term, as we look towards the end of this decade, rates will rise, perhaps by as much as 2-3% by 2020. But the rate of change will be extraordinarily slow, allowing your bond portfolio to reset naturally over time. As a result, those calling for a volatile environment appear alarmist to us.

Although predicting near-term market movements is a fools’ game, we do believe the absolute starting point for rates as well as the Federal Reserve’s “one and done” policy conveys a less aggressive stance than historical cycles. As a result, we suspect any so-called “Fed scare” will likely be mild and brief. And somewhat counter-intuitively, we believe that once a rate liftoff is considered certain and imminent, the S&P500 – assuming economic growth remains positive – may actually benefit, breaking out of its recent long standing trading range.

Longer-term, we continue to expect positive, but subdued return profiles for most financial asset classes, a reality of the current later stage economic environment. In general, it is reasonable to assume that returns will be modestly lower in the future than they have been in the past. After all, we have just experienced one of the biggest stock market rallies in history and this economic recovery’s best growth years are likely behind us.

That said, we are positioning stock portfolios for continued moderate economic growth, with a bias towards dividend stocks. Our general thesis is that we want to get “paid to wait” during this period of lower overall returns. Meanwhile, bond portfolios are positioned in a neutral manner as we see current interest rates now at equilibrium with underlying economic fundamentals. Finally, we see this environment as an opening for opportunistic investing, and continue to take advantage of investment opportunities as they present themselves around the world.

Even though it’s only been eight years and not eight centuries, the Federal Reserve’s “Great Charter” has certainly earned its place in history. Just as King John had to accept that he could no longer wield ultimate authority, so now the Federal Reserve is ready to do the same. Our view is the economic recovery is on solid footing, that a review of history tells us a more accurate story than the headlines of the day, and that the market is ready to stand on its own independent system of checks and balances.

Articles and Commentary

Information provided in written articles are for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Sand Hill Global Advisors' (“SHGA”) views as of the date of publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. SHGA does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. SHGA has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other websites maintained by third parties over whom SHGA has no control. SHGA makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. SHGA is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of SHGA.

Video Presentations

All video presentations discuss certain investment products and/or securities and are being provided for informational purposes only, and should not be considered, and is not, investment, financial planning, tax or legal advice; nor is it a recommendation to buy or sell any securities. Investing in securities involves varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular client’s financial situation or risk tolerance. Past performance is not a guarantee of future returns. Individual performance results will vary. The opinions expressed in the video reflect Sand Hill Global Advisor’s (“SHGA”) or Brenda Vingiello’s (as applicable) views as of the date of the video. Such views are subject to change at any point without notice. Any comments, opinions, or recommendations made by any host or other guest not affiliated with SHGA in this video do not necessarily reflect the views of SHGA, and non-SHGA persons appearing in this video do not fall under the supervisory purview of SHGA. You should not treat any opinion expressed by SHGA or Ms. Vingiello as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of general opinion. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based solely on any information provided on this video. There is a risk of loss from an investment in securities, including the risk of loss of principal. Neither SHGA nor Ms. Vingiello guarantees any specific outcome or profit. Any forward-looking statements or forecasts contained in the video are based on assumptions and actual results may vary from any such statements or forecasts. SHGA or one of its employees may have a position in the securities discussed and may purchase or sell such securities from time to time. Some of the information in this video has been obtained from third party sources. While SHGA believes such third-party information is reliable, SHGA does not guarantee its accuracy, timeliness or completeness. SHGA encourages you to consult with a professional financial advisor prior to making any investment decision.