The start of a new year often inspires reflections on the past, with renewed effort to apply any lessons we've learned to try to anticipate

Emerging Markets “Hukou Economics”

While domestic markets reached all-time highs in 2013, emerging markets stumbled and declined just over 2% for the year in comparison to the 27% returns in international developed markets. On an absolute basis this doesn’t seem so bad but, looking back at history, the last time a performance differential between emerging and developed markets this wide occurred was in 1998 during the Russian debt crisis. So, without a specific crisis, why did emerging markets perform so poorly? The year brought many changes including a shift in accommodative policy from the Federal Reserve, which caused a significant change in sentiment toward the group. When combined with weaker exports, lower commodity prices, weakening currencies and capital outflows, these countries experienced what some would term a “perfect storm.” As a result, the market has reset expectations. While it’s true that growth has moderated and the group continues to face structural headwinds, many forward indicators are starting to stabilize. One area of tremendous interest to us is policy support for China, the largest and most significant component of your emerging markets exposure.

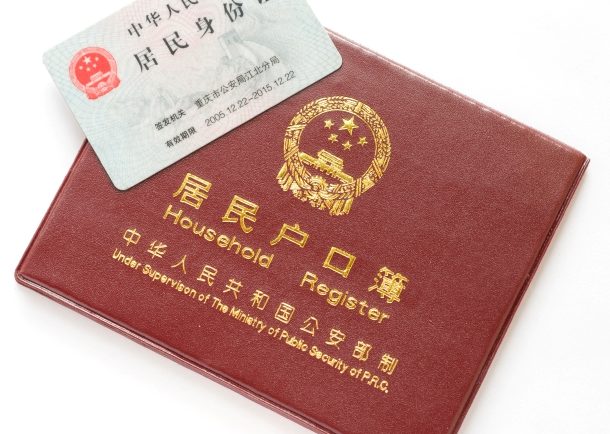

A policy item we are watching closely on your behalf is China’s household registration system, called hukou, which was implemented during the 1950s as a method to control population movement from rural areas to urban areas. Each citizen has access to social benefits such as education, housing and medical security as long as they remain in the region in which they’re registered. When workers move from rural areas to cities in search of better jobs they become unregistered and are no longer entitled to public services. It is estimated that approximately 20% of China’s population is living in unregistered households, forced to save a disproportionate amount of money for education, health care expenses and other potential emergencies. This has contributed to China’s very high savings rate, currently estimated at 38%, which compares to the U.S at just 3.9%.

During China’s Third Plenary Session, the government announced plans to accelerate hukou reform by relaxing rules relating to residency transfer as well as allowing rural residents to gain access to social services in smaller cities. The registration system will likely still remain in the country’s most populous cities, such as Beijing, as a method of controlling overcrowding. By some estimates, an increase in consumption by unregistered households previously denied benefits under hukou laws, could increase GDP by as much as 3%. Consumption in China drives an estimated 35% of GDP compared to the U.S. economy where consumption drives 71% of GDP. While this transformation will take time, it is directionally supportive of the growth of the middle class in China.

Following a moderation of growth in the fourth quarter of 2013, we expect economic growth in China to stabilize in early 2014. The government is currently targeting GDP growth of 7-7.5%; however, economic growth could accelerate beyond 8% in the coming quarters as a result of policy support from the government, as well as a continued pick up in global external demand. While market sentiment is heavily reflective of many of the emerging market countries’ challenges, we view the relative economic growth, and rise of the middle class as an attractive long-term investment opportunity. This led to our investment in emerging markets following the relative underperformance of the asset class during 2013 and demonstrates our disciplined investment process and long term contrarian approach.

Articles and Commentary

Information provided in written articles are for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Sand Hill Global Advisors' (“SHGA”) views as of the date of publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. SHGA does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. SHGA has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other websites maintained by third parties over whom SHGA has no control. SHGA makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. SHGA is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of SHGA.

Video Presentations

All video presentations discuss certain investment products and/or securities and are being provided for informational purposes only, and should not be considered, and is not, investment, financial planning, tax or legal advice; nor is it a recommendation to buy or sell any securities. Investing in securities involves varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular client’s financial situation or risk tolerance. Past performance is not a guarantee of future returns. Individual performance results will vary. The opinions expressed in the video reflect Sand Hill Global Advisor’s (“SHGA”) or Brenda Vingiello’s (as applicable) views as of the date of the video. Such views are subject to change at any point without notice. Any comments, opinions, or recommendations made by any host or other guest not affiliated with SHGA in this video do not necessarily reflect the views of SHGA, and non-SHGA persons appearing in this video do not fall under the supervisory purview of SHGA. You should not treat any opinion expressed by SHGA or Ms. Vingiello as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of general opinion. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based solely on any information provided on this video. There is a risk of loss from an investment in securities, including the risk of loss of principal. Neither SHGA nor Ms. Vingiello guarantees any specific outcome or profit. Any forward-looking statements or forecasts contained in the video are based on assumptions and actual results may vary from any such statements or forecasts. SHGA or one of its employees may have a position in the securities discussed and may purchase or sell such securities from time to time. Some of the information in this video has been obtained from third party sources. While SHGA believes such third-party information is reliable, SHGA does not guarantee its accuracy, timeliness or completeness. SHGA encourages you to consult with a professional financial advisor prior to making any investment decision.