Family governance is not a document you complete once and file away. It is a living system that grows and adapts just as the family

Emotional Investing and How to Avoid It

October 25, 2022

2022 has delivered some record drops in both the stock and bond markets. In the month of September alone, the S&P broke below the previous June closing low, declining 1.03%. Similarly, the Dow dropped another 1.11%. This type of volatility can be incredibly stressful for investors, and understandably so, but it should not be a time to panic. Instead, it’s often a sensible time to lean in. Investing based on our strongest emotions (like fear, greed, envy, or regret) can typically have very detrimental long-term effects on the “health” of our assets. In fact, the biggest risk may not be the volatility of the market itself, but instead, our reaction to the volatility.

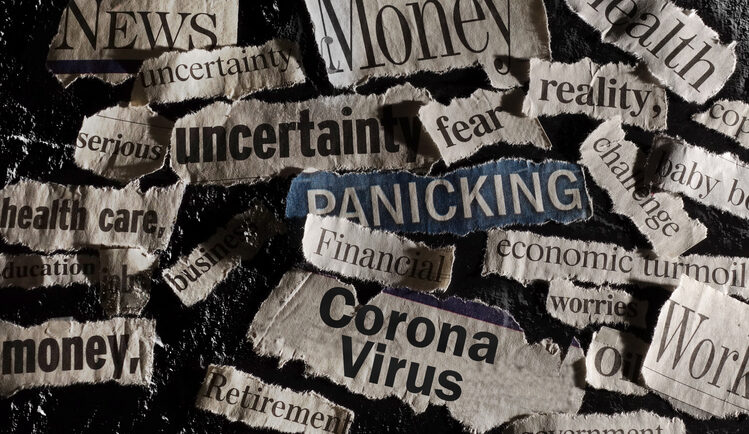

Emotional investing is often tied to the media and the firehose of information we are constantly facing—more so than ever before with the advent of 24/7 social media. And following all the twists and turns—and many dire predictions—can often induce bad timing in decision making. Historical analysis of collective money flows of investors buying at the top and selling at the bottom prove this point. Data reflecting new flows of funds into and out of mutual funds often shows that when markets are hitting peaks or valleys, buying or selling is at its highest, respectively.

In periods of volatility, it’s important to tap into—or get help in making—rational decisions. Giving in to fear (or even greed during euphoric periods) is often not a desirable strategy. The fact is the average investor gets the timing wrong. Studies conclusively show that the average investor underperforms the market over time due to moving in and out of investments way too often.

The typical market cycle of emotions is something that most if not all of us regularly experience in response to market conditions. The timeline follows optimism, euphoria, fear, surrender and then ultimately, back to the beginning. The best way to avoid adversely acting on some of these traps and protecting ourselves from our own emotions is to have a well-defined investment plan in place. It’s also important to remember that bear markets have consistently been shorter than bull markets. And while corrections are inevitable and unpredictable, they are also part of a normal market.

Time horizon, risk tolerance, and goal setting are all important factors in reducing the ever-present urge to trade on emotional instincts. Do you have more than five years in which you will need these funds? If so, you will likely see a market downturn in that span of time. Knowing ahead of time that you planned for the good, the bad, and the ugly market returns can help keep the focus on the long term instead of being derailed by constant shorter-term events.

There is risk inherent in nearly everything we do but it can usually be actively managed. Often, multiple different types of risk exist, from daily price action to longer-term purchasing power concerns. Proper identification and measurement of various risks and keeping them all aligned with your goals are key factors in determining proper portfolio allocation. And having the proper allocation and strategy can make a huge difference in how one reacts to volatility, including the right mix of stocks, bonds, cash, and other alternatives that minimize overall risk while striving to meet your needs and objectives for return expectations. As life goes on, and situations change, your allocation likely will, too.

Just like life, financial markets have cycles. As it relates to market cycles, emotions tend to get in the way. Fear and greed can beat out the rational mind, and hence too many investors end up acting on what they want to do instead of what they should do. Successful investors do the opposite.

Sources:

www.fidelity.com/spire/the-market-cycle-and-investors

www.doughroller.net/investing/heres-what-you-should-do-instead-of-panic-selling/#the-bottom-line

www.investopedia.com/articles/basics/10/how-to-avoid-emotional-investing.asp#toc-bad-timing

www.fool.com/investing/2018/02/07/warren-buffetts-playbook-for-a-stock-market-correc.aspx

Articles and Commentary

Information provided in written articles are for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Sand Hill Global Advisors' (“SHGA”) views as of the date of publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. SHGA does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. SHGA has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other websites maintained by third parties over whom SHGA has no control. SHGA makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. SHGA is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of SHGA.

Video Presentations

All video presentations discuss certain investment products and/or securities and are being provided for informational purposes only, and should not be considered, and is not, investment, financial planning, tax or legal advice; nor is it a recommendation to buy or sell any securities. Investing in securities involves varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular client’s financial situation or risk tolerance. Past performance is not a guarantee of future returns. Individual performance results will vary. The opinions expressed in the video reflect Sand Hill Global Advisor’s (“SHGA”) or Brenda Vingiello’s (as applicable) views as of the date of the video. Such views are subject to change at any point without notice. Any comments, opinions, or recommendations made by any host or other guest not affiliated with SHGA in this video do not necessarily reflect the views of SHGA, and non-SHGA persons appearing in this video do not fall under the supervisory purview of SHGA. You should not treat any opinion expressed by SHGA or Ms. Vingiello as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of general opinion. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based solely on any information provided on this video. There is a risk of loss from an investment in securities, including the risk of loss of principal. Neither SHGA nor Ms. Vingiello guarantees any specific outcome or profit. Any forward-looking statements or forecasts contained in the video are based on assumptions and actual results may vary from any such statements or forecasts. SHGA or one of its employees may have a position in the securities discussed and may purchase or sell such securities from time to time. Some of the information in this video has been obtained from third party sources. While SHGA believes such third-party information is reliable, SHGA does not guarantee its accuracy, timeliness or completeness. SHGA encourages you to consult with a professional financial advisor prior to making any investment decision.