The start of a new year often inspires reflections on the past, with renewed effort to apply any lessons we've learned to try to anticipate

Europe: Between a Rock and a Hard Place

“A fronte praecipitium, a tergo lupi” – Latin Idiom lit: “a precipice in front, wolves behind”

The world economy once again stands upon a precipice. As the developed economies post slower growth and the emerging economies debate whether inflation or recession is the greater threat, the need for global balance between fiscal austerity and economic growth has rarely been as imperative.

Although the debate is global in nature, the crisis is most acute inside the European Union, where policy makers must now address the sovereign debt and banking challenges that have built up over the past decade – or face a potentially far less palatable outcome. As the volatility of the global markets have illustrated this summer, the intricacies of today’s financial markets make us all Europeans now.

Unfortunately, European policy, thus far, has proven to be erratic, dysfunctional and behind the curve. Throughout every stage of the process, the authorities have done just enough to avoid an imminent collapse, but never enough to establish a sound foundation for a resumption of confidence.

While it is certainly sobering to think that the global economic recovery depends on the leadership of squabbling European politicians who have consistently underestimated what confronts them, nevertheless Sand Hill’s outlook is that policy makers will do enough to prevent a full-scale banking and sovereign debt crisis from unfolding.

Not surprisingly, given the “crisis of confidence” that has occurred – both around the elevated risks of a global recession as well as the less likely, but far more damaging potential for a second credit market crisis – stock markets worldwide posted their worst quarterly performance since 2008. The S&P500 lost approximately 14% of its value in the quarter while international and emerging markets, as well as smaller stocks here in the United States, fared significantly worse. Meanwhile, the Treasury market posted a positive return as investors sought safe haven assets.

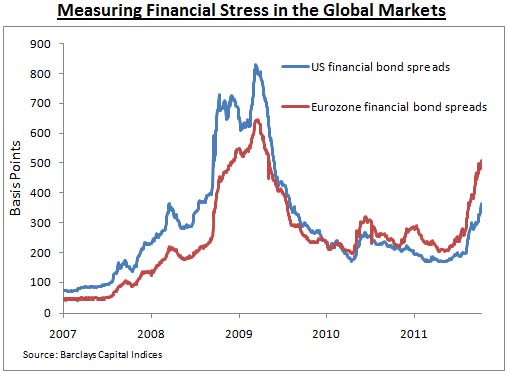

The price action this quarter was remarkably reminiscent of that witnessed in late 2008, when deleveraging and credit market concerns dominated the day-to-day price action of the market at the expense of all other news flow. As the chart above depicts, financial conditions in Europe are rapidly approaching 2008 levels. For a variety of reasons, mostly due to the less severe nature of this aftershock as well as the lower level of contagion risk, the United States is showing elevated but less intense risk than Europe today or versus our general experience during the Financial Crisis.

It is important to recognize that the US economy and the markets are responding to a “confidence shock” precipitated by Europe rather than a true underlying downturn. While the soft data points (like consumer and business confidence) have weakened, the cyclical recovery by the hard data points (industrial production, orders, output) have proven to be remarkably resilient. We like to watch what people do, not what they say in our process – and our conclusion is that the underlying world (economic reality) has not changed as fast as the headline stock market indices (investor fears).

However, in response to the intensifying financial dislocations in Europe as well as moderately deteriorating economic momentum, we have tempered our macroeconomic and asset price forecasts. We now forecast Europe will enter a mild recession in 2012. Additionally, we believe that the United States will escape a prolonged downturn and enter a period of stagnant but positive growth with an underlying growth rate of a 1.5%-2.5% (down from our prior expectation of a positive 2%-3%). Interestingly, although historically subpar in their absolute strength, macro indicators over the most recent period have actually been above consensus expectations – although widely ignored by the market given the “Black Swan” nature of potentially unchecked credit market risk in Europe.

As of this writing, markets have fairly well priced in all but the most draconian on scenarios. Valuations have compressed to abnormally inexpensive levels and now reflect a global recession unfolding as well as a general despondency among exhausted investors. By almost every fundamental and technical measure we monitor, markets are in a broadly oversold condition.

We do suspect markets will regain some of their footing with any resolution out of Europe – as investors will no longer fear a banking sector relapse. Of some relevance: dramatic declines in the market like the one witnessed in the third quarter have historically led to similar gains – outside of bear market environments. But how sustainable will that recovery be in a post-stimulus driven world? As governments around the globe invoke fiscal austerity and learn to live within their means – and as individuals continue their personal deleveraging process in the aftermath of the 2008 Financial Crisis – economic headwinds will continue to constrain our growth potential.

Throughout the year, Sand Hill has maintained its disciplined approach, reducing market exposure earlier in the year near the peak of the intervention-inspired rally and using the pullback in the most recent quarter as an opportunity to “go shopping” for high quality assets that went on sale as a result of the troubles in Europe. The importance of a balanced portfolio containing uncorrelated investments has proven to be particularly relevant in this environment.

With market volatility and bank stress indicators elevated, a shift in European policy is needed to stop these adverse market dynamics. We expect that a “roadmap to resolution” is in the works for Europe. In the meantime, although we do believe markets will have an upward bias, a sustained advance beyond simply correcting our oversold position will likely prove difficult – until a European solution is announced. We don’t have great expectations in the immediate term, nor do we see, outside of continued volatility, a significant downside scenario. We simply find ourselves between a rock and a hard place – and with few heroes stepping forward in Europe, we don’t see the need to be one either.

Articles and Commentary

Information provided in written articles are for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Sand Hill Global Advisors' (“SHGA”) views as of the date of publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. SHGA does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. SHGA has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other websites maintained by third parties over whom SHGA has no control. SHGA makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. SHGA is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of SHGA.

Video Presentations

All video presentations discuss certain investment products and/or securities and are being provided for informational purposes only, and should not be considered, and is not, investment, financial planning, tax or legal advice; nor is it a recommendation to buy or sell any securities. Investing in securities involves varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular client’s financial situation or risk tolerance. Past performance is not a guarantee of future returns. Individual performance results will vary. The opinions expressed in the video reflect Sand Hill Global Advisor’s (“SHGA”) or Brenda Vingiello’s (as applicable) views as of the date of the video. Such views are subject to change at any point without notice. Any comments, opinions, or recommendations made by any host or other guest not affiliated with SHGA in this video do not necessarily reflect the views of SHGA, and non-SHGA persons appearing in this video do not fall under the supervisory purview of SHGA. You should not treat any opinion expressed by SHGA or Ms. Vingiello as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of general opinion. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based solely on any information provided on this video. There is a risk of loss from an investment in securities, including the risk of loss of principal. Neither SHGA nor Ms. Vingiello guarantees any specific outcome or profit. Any forward-looking statements or forecasts contained in the video are based on assumptions and actual results may vary from any such statements or forecasts. SHGA or one of its employees may have a position in the securities discussed and may purchase or sell such securities from time to time. Some of the information in this video has been obtained from third party sources. While SHGA believes such third-party information is reliable, SHGA does not guarantee its accuracy, timeliness or completeness. SHGA encourages you to consult with a professional financial advisor prior to making any investment decision.

Other Posts By This Author

- – A New Year’s Toast to the Silicon Valley Entrepreneur

- – How I Learned to Love the Bot

- – Thank You for Your Partnership

- – The Coming Deglobalization

Related Posts