When you work with a wealth advisor, investment and financial planning experience is expected. But what truly defines an exceptional advisory relationship is something deeper:

Resolutions

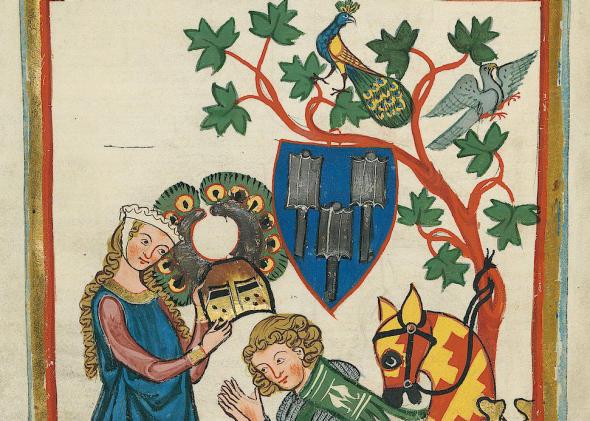

“It was on this day when a solemn vow was made that the peacock became the great object of admiration, and whether it appeared at the banquet given on these occasions roasted or in its natural state, it always wore its full plumage … before all the assembled chivalry … and each made his vow to the bird.” – Charles Dickens, All the Year Round

The ancient Babylonians made annual promises to pay off their debts and return borrowed items. The Romans would begin each year with a promise to the god of beginnings and transitions, Janus, for whom the month of January is named. And as Charles Dickens described above, medieval knights took their own version of the New Year’s resolution, taking their “peacock vow” to re-affirm their commitment to chivalry at the end of each year.

The tradition of reflecting on the year that was, tallying up the rewards of our accomplishments against the costs of our failings, and recommitting ourselves to core principles and betterment in the year to come, is a timeless and important discipline – and in the investment business, a tradition of time well-spent.

The New Year kicks off much where 2013 began, with investors riding the wave of liquidity pumped into the financial markets by the world’s major central banks. The sheer amount of liquidity that has been added to the global financial system over the past five years, since the collapse of Lehman Brothers, has been unprecedented: the combined balance sheets of the G7 central banks has tripled in size over this time. This has been a highly favorable period for stock market returns. Yet it has, at the same time, been a distinctly mediocre time for the global economy.

This begs two questions: Have central bank actions left all asset classes relatively expensive? And what impact, if any, will the change in leadership and policy direction at the Federal Reserve have on global stock and bond market returns in the coming year?

In being so aggressive, central bank liquidity tends to swamp fundamental outcomes, and indeed, for most of 2013, stock markets seemed almost indifferent to whether fundamental economic data was good or bad. While being indifferent to economic outcomes is usually a sign of complacency, the “Bernanke Put” remained in place, encouraging investors to assume risk and muting overall market volatility A virtuous circle unfolded for stock market investors. As we say goodbye to the long-standing implicit insurance policy known as the “Bernanke Put” in 2014, how will markets react to its removal?

Ultimately all long-term investors truly care about, assuming fundamentals are improving, is whether the sentiment of the moment has pushed valuation beyond reasonable levels. And by most measures, it appears valuations for stocks look fair to only slightly high by historical standards. With the economy experiencing its first reacceleration since 2010, corporate earnings will continue to grow, although further multiple expansion is unlikely. The net result should be markets posting a positive but more normalized year in 2014. However, as we unwind excess liquidity, investors should anticipate higher market volatility relative to what we experienced during the abnormally smooth 2013. Given the improving economic backdrop, those inevitable pullbacks will be opportunistically approached by our firm.

But absolute return expectations, for a globally allocated portfolio, are only part of the equation as we enter 2014. Equally important for overall returns will be how the different components of your portfolio interact with one another. Central bank actions made that normally balanced dynamic, a highly lopsided, “winner take all” environment in 2013. With the benefit of perfect hindsight, it would have been best to simply ignore the laws of finance and have made an all-in bet on U.S. stocks last year. Unlike the colorful peacocks admired by the knights of old, the more colorful your investment allocation pie chart was this year, the worse your outcome against an all-in bet on U.S. stocks turned out to be.

For example, European stocks rose but underperformed the US by a wide margin. Emerging market stocks, which often perform well during economic expansions, declined 2%, with China down roughly 8%. Commodities, usually beneficiaries of global growth, dropped 9% and agricultural commodities fell 14%. Even gold, which investors tend to use as a hedge against inflation and an insurance policy against global turmoil, tumbled 28%. Meaningful to many retirees, bonds fell 2%, their first annual decline since 1999, while 10-year treasury inflation protected securities (TIPS) lost 12% and hedge funds lagged far behind the broader market.

The world doesn’t usually unfold this way in big stock market rally years. A more typical big market year, like 2003, saw markets rise similarly, but international markets, emerging markets, commodities and even bonds all posted strong gains. And, of course, long-term investing is not an annual practice of looking into your crystal ball and then putting 100% of your assets into your forecasted choice. Asset allocation is about building a portfolio to generate a consistent rate of return over a complete market cycle – and not taking one iota more in risk than you have to in order to secure that return.

Interestingly, had you had a perfect crystal ball, and it told you to invest only in the countries with the lowest GDP growth, the most central bank intervention, the highest debt and deficit levels and the worst demographics, you probably would have suspected a malfunction!

Myopic markets are not necessarily to be feared. It’s become fashionable to talk of market distortions and dislocations, but like medicine that cures the disease with some negative side effects, the actions of the Bernanke Federal Reserve have proven remarkably effective at achieving what they set out to do. Economic growth is accelerating, inflation remains subdued and the “animal spirits” have re-emerged. We actually see 2014 as perhaps the first “normal year” since before the Great Recession, where cyclical outcomes will be more important than global macro ones. And normal years tend to reward disciplined, fundamental investors – and well-diversified, balanced portfolios.

Like the knights’ “peacock vow” to chivalry, Sand Hill’s modern day equivalent is to the fiduciary standard: to always put the needs of our clients above all else, and to build well-diversified, balanced portfolios that are designed to provide a risk-adjusted return optimized for the environment we are in today. Dynamic years like 2013 can test these tried and true standards but we remain committed to our core principles. And investment wisdom begins with the understanding that investment disciplines – and their resulting outcomes – should be measures over decades, not days.

Articles and Commentary

Information provided in written articles are for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Sand Hill Global Advisors' (“SHGA”) views as of the date of publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. SHGA does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. SHGA has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other websites maintained by third parties over whom SHGA has no control. SHGA makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. SHGA is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of SHGA.

Video Presentations

All video presentations discuss certain investment products and/or securities and are being provided for informational purposes only, and should not be considered, and is not, investment, financial planning, tax or legal advice; nor is it a recommendation to buy or sell any securities. Investing in securities involves varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular client’s financial situation or risk tolerance. Past performance is not a guarantee of future returns. Individual performance results will vary. The opinions expressed in the video reflect Sand Hill Global Advisor’s (“SHGA”) or Brenda Vingiello’s (as applicable) views as of the date of the video. Such views are subject to change at any point without notice. Any comments, opinions, or recommendations made by any host or other guest not affiliated with SHGA in this video do not necessarily reflect the views of SHGA, and non-SHGA persons appearing in this video do not fall under the supervisory purview of SHGA. You should not treat any opinion expressed by SHGA or Ms. Vingiello as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of general opinion. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based solely on any information provided on this video. There is a risk of loss from an investment in securities, including the risk of loss of principal. Neither SHGA nor Ms. Vingiello guarantees any specific outcome or profit. Any forward-looking statements or forecasts contained in the video are based on assumptions and actual results may vary from any such statements or forecasts. SHGA or one of its employees may have a position in the securities discussed and may purchase or sell such securities from time to time. Some of the information in this video has been obtained from third party sources. While SHGA believes such third-party information is reliable, SHGA does not guarantee its accuracy, timeliness or completeness. SHGA encourages you to consult with a professional financial advisor prior to making any investment decision.

Other Posts By This Author

- – A New Year’s Toast to the Silicon Valley Entrepreneur

- – How I Learned to Love the Bot

- – Thank You for Your Partnership

- – The Coming Deglobalization

Related Posts