The start of a new year often inspires reflections on the past, with renewed effort to apply any lessons we've learned to try to anticipate

The Yield Curve and Recessions. Relationship Status: It’s Complicated

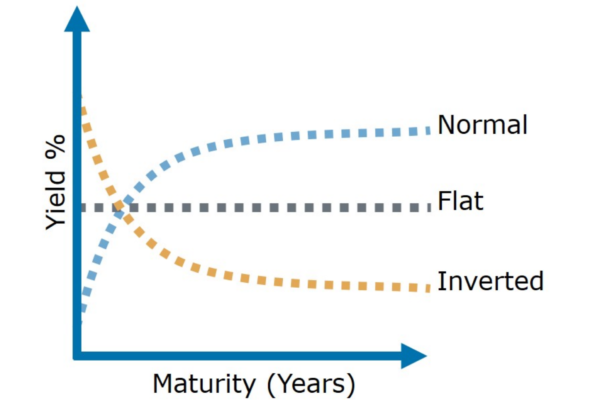

Is the yield curve telling us we are headed for a recession? Since the 1950’s, all U.S. recessions have been preceded by an inverted Treasury yield curve, which occurs when short-term interest rates exceed long-term interest rates. Given this historical correlation and the shape of the yield curve today, it is worth exploring this complicated relationship a bit further.

To be clear: the yield curve is flat, but it is currently not inverted. Granted, it is increasingly flat these days, and the reason is because the Federal Reserve has raised short-term interest rates eight times since 2015 in response to stronger economic data. Meanwhile long-term U.S. bond yields have been slower to rise, partly due to comparatively low interest rates elsewhere around the globe. Even so, let’s say the yield curve does invert. Would that mean it’s time to position portfolios for a recession?

Not so fast. Despite the eye-catching headlines, an inverted yield curve is not an immediate measure of a recession, and the actionable timing between the two has been inconsistent. Since the 1950s, it has taken anywhere from a few months to a few years before a recession began after the yield curve inverted. There have also been false positives when the yield curve inverted, with no recession following. For example, consider late 1994 when the yield curve was flatter than it is today and the spread between 2-year and 10-year Treasuries dropped to a razor-thin 0.12%. If you had sold stocks in anticipation of an inverted yield curve and a recession, you would have missed out on the very strong bull market of the late 1990s. In addition, four of the last five times the Treasury yield curve inverted, the S&P 500 recorded gains for another 18 months.

One reasonable concern is that an inverted yield curve leads to a slowdown in economic activity. Since banks borrow at short-term rates and lend at long-term rates, a flatter yield curve tends to imply lower profitability, causing banks to make fewer loans which, in turn, leads to slower economic activity. A lot of people point to the spread between 2-year and 10-year Treasuries as cause for concern given the spread is only about 35 basis points, or 0.35%, as of early October. However, this is not the best metric to use. Banks typically do not borrow at 2-year rates; instead, they borrow much shorter than that. According to research by the San Francisco Federal Reserve, the spread between 3-month Treasury bills and 10-year Treasuries is the most useful term spread for forecasting recessions. And today, that spread is 100 basis points away from inversion. While this spread is tighter than it was a year ago, it is still quite far from inverting.

One thing to keep in mind is that recessions occur when monetary conditions become so restrictive that they cripple economic growth. We do not believe that we are in such a restrictive environment today — nor at risk of being there anytime soon. Indeed, after adjusting for inflation, real U.S. short-term rates are <0.47%>. Yes, we know, it’s hard to believe that “real” short-term U.S. rates are still in negative territory. And yet, we do not think a slight negative real rate is going to bring the U.S. economy to its knees; and based on its economic projections and reiterated policy plans, neither does the Federal Reserve.

In summary, the yield curve has been flattening and it will almost certainly invert before the next recession. However, we do not think this presents an immediate concern nor do we think a recession is imminent. In fact, the yield curve recently steepened, as long-term rates moved significantly higher. Recent U.S. economic data remains strong, corporate tax cuts are expanding this cycle, and the Federal Reserve is still hiking. Based on those realities, we believe the flattening yield curve is not a reason for concern and following this period of adjustment, the markets will continue to climb the wall of worry because the curve is flattening for the right reasons.

Sources: U.S. Department of the Treasury, Federal Reserve Bank of San Francisco, Federal Reserve Bank of St. Louis, Allianz Global Investors.

Image from: https://www.colotrust.com/the-shape-of-the-u-s-treasury-yield-curve/

Articles and Commentary

Information provided in written articles are for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Sand Hill Global Advisors' (“SHGA”) views as of the date of publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. SHGA does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. SHGA has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other websites maintained by third parties over whom SHGA has no control. SHGA makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. SHGA is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of SHGA.

Video Presentations

All video presentations discuss certain investment products and/or securities and are being provided for informational purposes only, and should not be considered, and is not, investment, financial planning, tax or legal advice; nor is it a recommendation to buy or sell any securities. Investing in securities involves varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular client’s financial situation or risk tolerance. Past performance is not a guarantee of future returns. Individual performance results will vary. The opinions expressed in the video reflect Sand Hill Global Advisor’s (“SHGA”) or Brenda Vingiello’s (as applicable) views as of the date of the video. Such views are subject to change at any point without notice. Any comments, opinions, or recommendations made by any host or other guest not affiliated with SHGA in this video do not necessarily reflect the views of SHGA, and non-SHGA persons appearing in this video do not fall under the supervisory purview of SHGA. You should not treat any opinion expressed by SHGA or Ms. Vingiello as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of general opinion. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based solely on any information provided on this video. There is a risk of loss from an investment in securities, including the risk of loss of principal. Neither SHGA nor Ms. Vingiello guarantees any specific outcome or profit. Any forward-looking statements or forecasts contained in the video are based on assumptions and actual results may vary from any such statements or forecasts. SHGA or one of its employees may have a position in the securities discussed and may purchase or sell such securities from time to time. Some of the information in this video has been obtained from third party sources. While SHGA believes such third-party information is reliable, SHGA does not guarantee its accuracy, timeliness or completeness. SHGA encourages you to consult with a professional financial advisor prior to making any investment decision.