Utilizing Home Equity to Meet Long-Term Needs and Objectives

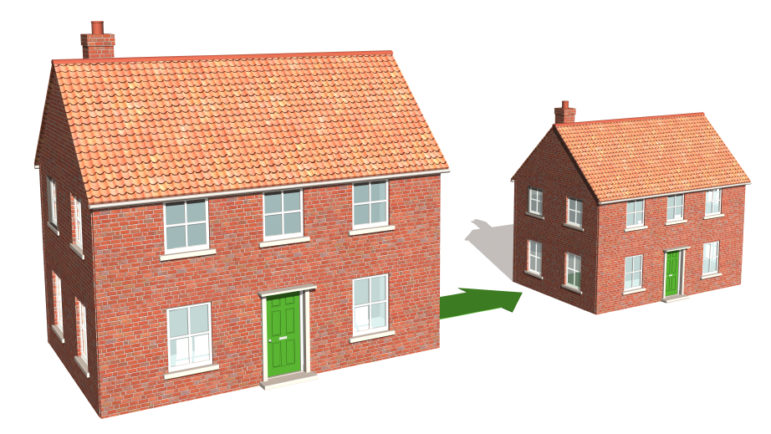

The term downsizing typically connotes difficult decisions, often conjuring up images of harsh corporate layoffs. But downsizing also commonly describes the sensible and often rewarding —even cathartic — act of moving from a large house into a smaller and more manageable living arrangement. Of course, this act can sometimes be involuntary too, such as when older people — often single, surviving spouses — can no longer live alone in their home and/or can no longer afford to stay in it with the possibility of forcing an abrupt departure.

But home downsizing can typically be handled proactively and positively, enabling occupants to remain in full control of the process and looking forward to the multiple benefits that can come from their actions—from reducing stress and associated costs and burdens of home ownership and maintenance, to freeing up significant funds (from the equity in their homes) to help meet ongoing living expenses. Such benefits can last for many years, and provide great comfort and assurance. Indeed, maybe such downsizing should instead be called rightsizing.

Usually downsizing (or rightsizing) occurs later in life, after families have been raised and once parents have become empty-nesters. Sometimes this takes place even after the next generation has passed through the home as well, with grandchildren enjoying the place for many years, too. Many factors come into play in the decision to move at this later stage of the game, including physical ability to stay put or not, property management and upkeep desires and skills, and basic financial considerations including overall wealth and expenses—both home-related and in general.

Of course, some people have the resources to remain where they are indefinitely, regardless of the size or upkeep of the house or anything else; and they can also employ additional help and services, if necessary, to address other factors at play, like possible health related considerations and limitations. But many others cannot. Fortunately, here in the Bay Area and elsewhere, home values have appreciated nicely for many years—unlike some parts of the country—and thus many long-term homeowners are literally sitting, and sleeping, on top of potential valuable resources for creative personal financial planning.

There are also many different possibilities for handling the value in a family home (including, but not limited to, those highlighted below), and this overall subject is wide-open to all sorts of interesting and clever considerations. This article, however, focuses simply on the first option listed here of selling outright and monetizing the equity in the home in order to help provide ongoing resources to the homeowner; but some of the other options include:

- Selling it outright (either before or after any possible step-up in cost basis and/or with any possible capital gain exemption or available age-related transfer of property tax basis)

- Capital Gain Exemption ($500k married/$250k individual)

- California Propositions 60 and 90 (age-based property tax transfers), for those who reside in the State of California

- Giving it away (to charity—and possibly creating an income stream

- Converting to investment property (1031 exchange; generating income stream)

- Transferring it to the next generation (including potential discounted gift valuations and/or cost basis and property tax considerations)

- Qualified Personal Residence Trust (QPRT)

- Proposition 58 (property tax transfers among family members)

- Lifetime Gift/Estate Tax Exemption

- Reverse mortgage (staying put and generating income)

- Renting it out (for income)

In addition to the well-known deductibility for tax purposes of mortgage interest and property taxes (except for AMT purposes), there are other unique advantages given to homeownership including the favorable treatment of the realization of gain on the sale of a personal residence. However, it is important to understand that past provisions have been replaced by one simple current exemption that’s been in place since 1997. Married couples can exempt up to $500,000 in gain on a sale or half that amount for individuals. This exemption can effectively be taken as often as every two years as long as the owner has occupied the property for sale for at least two of the five preceding years.

Another favorable tax consideration available in California is the ability to potentially transfer property tax basis, a policy effectively designed to encourage downsizing. Known as the Proposition 60 transfer, after the 1986 ballot initiative that established it, homeowners who are older than 55 or disabled can sell their primary residence and buy another house for equal or less value (within two years of the sale), and transfer their previous property tax base into their new home. The new house must be located within the same county, or within a limited number of counties that accept such transfers. This second, local option feature is known as the Prop 90 transfer, and only about ten counties currently participate.

For example, an empty-nest couple could sell their big house in San Francisco County and transfer their existing property tax base into a new, more manageable smaller house in San Mateo County. This specific transfer would not work in reverse, though, because San Francisco does not accept such transfers. Obviously, the effects of any potential capital gains tax would also need to be considered in the overall analysis. Furthermore, Prop 90 transfers are one-time benefits. Once granted, the applicant (or even the future spouse of the applicant) is no longer eligible to get another transfer.

There is also the full step-up in cost basis available at death of the first spouse, which can be extremely useful to a surviving spouse or for other estate planning purposes. The surviving spouse could then also get another step-up at his or her death, if there were further price appreciation since the initial step up, a common occurrence when there is a sizable age difference between spouses. For example, a house bought decades ago at a much lower purchase price (cost basis) would be fully marked up to today’s fair market value on the entire property if it’s held as community property; and thus all of the previous unrealized gain would be readjusted and eliminated. This step-up at death feature applies to other assets too, but it can be especially attractive and useful for the family home, since small pieces of a home cannot be sold off along the way like shares in a stock/bond portfolio, thereby potentially avoiding an otherwise large taxable gain on the ultimate sale of a long-held house. In essence, this feature enables “new” possibilities.

Sand Hill Global Advisors helps homeowners and their real estate professionals think through and test such new possibilities. When people arrive at a stage in life where they are considering such downsizing in their living arrangements, we can help examine the possibilities and complement the other important advice and assistance that they are getting from their trusted real estate professionals.

The services that Sand Hill Global Advisors offers include:

- scenario planning using Monte Carlo1 simulations to test spending assumptions and other cash flow and asset durability projections

- proper risk management and asset allocation assessment

- prudent return and inflation expectations

- appropriate investment strategy selection and portfolio construction

All of this reasoning and planning is critical to the overall analysis of determining whether sufficient funds will be freed up—after the purchase of any replacement property—to meet ongoing living expenses and other long-term needs and desires.

We provide objective, trusted and independent advice—to both homeowners and real estate professionals—to help achieve successful outcomes in these situations.

1 Monte Carlo Simulation is a probability analysis that provides a range of outcomes that an investment portfolio is capable of producing. The analysis incorporates historical economic data such as a range of potential market returns, interest rates, inflation rates, tax rates, and so on. The data is combined in random order to account for the uncertainty and performance variation that is always present in financial markets.

Articles and Commentary

Information provided in written articles are for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Sand Hill Global Advisors' (“SHGA”) views as of the date of publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. SHGA does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. SHGA has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other websites maintained by third parties over whom SHGA has no control. SHGA makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. SHGA is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of SHGA.

Video Presentations

All video presentations discuss certain investment products and/or securities and are being provided for informational purposes only, and should not be considered, and is not, investment, financial planning, tax or legal advice; nor is it a recommendation to buy or sell any securities. Investing in securities involves varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular client’s financial situation or risk tolerance. Past performance is not a guarantee of future returns. Individual performance results will vary. The opinions expressed in the video reflect Sand Hill Global Advisor’s (“SHGA”) or Brenda Vingiello’s (as applicable) views as of the date of the video. Such views are subject to change at any point without notice. Any comments, opinions, or recommendations made by any host or other guest not affiliated with SHGA in this video do not necessarily reflect the views of SHGA, and non-SHGA persons appearing in this video do not fall under the supervisory purview of SHGA. You should not treat any opinion expressed by SHGA or Ms. Vingiello as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of general opinion. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based solely on any information provided on this video. There is a risk of loss from an investment in securities, including the risk of loss of principal. Neither SHGA nor Ms. Vingiello guarantees any specific outcome or profit. Any forward-looking statements or forecasts contained in the video are based on assumptions and actual results may vary from any such statements or forecasts. SHGA or one of its employees may have a position in the securities discussed and may purchase or sell such securities from time to time. Some of the information in this video has been obtained from third party sources. While SHGA believes such third-party information is reliable, SHGA does not guarantee its accuracy, timeliness or completeness. SHGA encourages you to consult with a professional financial advisor prior to making any investment decision.