The start of a new year often inspires reflections on the past, with renewed effort to apply any lessons we've learned to try to anticipate

What’s Your Special Purpose?

April 22, 2021

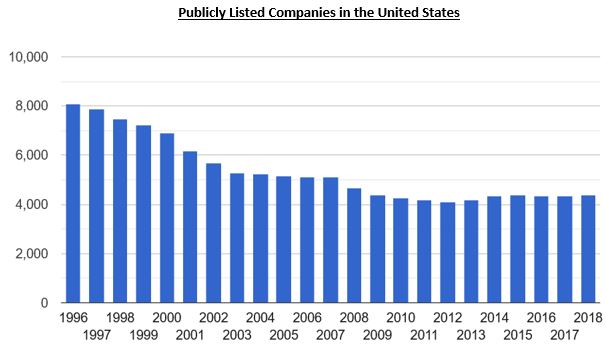

From 1996 to 2018, the number of publicly listed companies in the United States fell by more than 45%. This stunning statistic is the result of ongoing mergers and acquisitions, plus the vast amounts of capital available to private companies and the perceived regulatory hurdles associated with going public. Not since the “Nifty Fifty” in the 1970s have we had such a concentrated group of publicly traded companies, and that’s not necessarily a good thing for investors—or for consumers for that matter. But thanks to the re-emergence of SPACs, an acronym for Special Purpose Acquisition Companies, that trend may now be reversing.

SPACs are colloquially referred to as “blank check” companies because investors who buy into their shares do not know what their investment will ultimately become. Often vilified in the press as a sign of market exuberance—and occasionally tarnished by the presence of low-quality backers or the distraction of celebrity endorsements—these structures nonetheless exist with the single goal of streamlining the process of taking a private company public without all of the time, expense, and regulatory oversight required by the traditional public offering process.

Originally a back-water financial structure first developed in the 1990s, SPACs this go-around hold a completely different connotation as a disruptive innovation whose time has come. Last year alone, a record 248 SPACs listed compared to just 209 traditional initial public offerings (IPOs). And that trend only accelerated into early 2021, with SPAC issuance accounting for about 70% of all newly public companies in the first quarter, according to Dealogic. Sports-betting firm Draft-Kings, space-tourism company Virgin Galactic, personal genomics company 23&Me, as well as a host of other private companies have all utilized this financial structure.

Traditional IPOs still clearly have their benefits, including greater visibility and prestige, but they can be costly and time intensive. An IPO can take two to three years to close, whereas a SPAC can be completed in as little as two to three months. Additionally, SPACs have to make fewer disclosures, can provide forward guidance once they announce their acquisition target, and set their own deal valuation as opposed to an initial public offering process where the offering price can change dramatically based on the strength of the investment bank’s book-building process.

To be sure, not all SPAC deals will be successful—and “streamlined processes” is also a euphemism for less protection and less transparency for individual investors, which has rightfully prompted increased scrutiny from regulators. Additionally, the economics for insiders can be substantial and associated fees are typically greater than those collected by investment banks for traditional initial public offerings. But investors have the option of redeeming their shares at the SPACs offering price if they do not like their acquisition target and they can also benefit from the pairing of warrants with their shares, which can provide an extra “kicker” to one’s investment returns if the stock rises over time.

While the SPAC structure certainly has its pros and cons, from a big picture perspective, they are increasingly the vehicle of choice for private companies seeking a sophisticated response to the structural issues of going public—and that is potentially a positive development for the markets overall. Only time will tell if they serve this special purpose, but this go around, SPAC may not be the four-letter word that today’s headlines suggest.

Source: World Bank

Articles and Commentary

Information provided in written articles are for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Sand Hill Global Advisors' (“SHGA”) views as of the date of publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. SHGA does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. SHGA has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other websites maintained by third parties over whom SHGA has no control. SHGA makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. SHGA is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of SHGA.

Video Presentations

All video presentations discuss certain investment products and/or securities and are being provided for informational purposes only, and should not be considered, and is not, investment, financial planning, tax or legal advice; nor is it a recommendation to buy or sell any securities. Investing in securities involves varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular client’s financial situation or risk tolerance. Past performance is not a guarantee of future returns. Individual performance results will vary. The opinions expressed in the video reflect Sand Hill Global Advisor’s (“SHGA”) or Brenda Vingiello’s (as applicable) views as of the date of the video. Such views are subject to change at any point without notice. Any comments, opinions, or recommendations made by any host or other guest not affiliated with SHGA in this video do not necessarily reflect the views of SHGA, and non-SHGA persons appearing in this video do not fall under the supervisory purview of SHGA. You should not treat any opinion expressed by SHGA or Ms. Vingiello as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of general opinion. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based solely on any information provided on this video. There is a risk of loss from an investment in securities, including the risk of loss of principal. Neither SHGA nor Ms. Vingiello guarantees any specific outcome or profit. Any forward-looking statements or forecasts contained in the video are based on assumptions and actual results may vary from any such statements or forecasts. SHGA or one of its employees may have a position in the securities discussed and may purchase or sell such securities from time to time. Some of the information in this video has been obtained from third party sources. While SHGA believes such third-party information is reliable, SHGA does not guarantee its accuracy, timeliness or completeness. SHGA encourages you to consult with a professional financial advisor prior to making any investment decision.

Other Posts By This Author

- – A New Year’s Toast to the Silicon Valley Entrepreneur

- – How I Learned to Love the Bot

- – Thank You for Your Partnership

- – The Coming Deglobalization

Related Posts